Alas... As always, CV faces a "fickle finger of fate"...

EACH & EVERY DAY he risks exceeding the boundaries of political correctness... (Sometimes - the audience just isn't "LAUGH-IN")... Indeed - This blog doesn't come with an imbedded "laugh track", but maybe I could find one... Maybe a few more Justin Beiber videos would suffice...

But today I have help (in the mirth category)... It's IMBEDDED... It's FOMC Day!... And while I know you all (and the markets) wait with nervous anticipation on how to TRADE THE NEWS later on... There's still the matter of "how do we pass our ZERO VOLUME moments" up until that moment arrives?... So I thought I'd give you an IN DEPTH look at actually how the FOMC comes up with policy decisions (or the history thereof)...

From the FED's own website:

"The Federal Reserve controls the three tools of monetary policy--open market operations, the discount rate, and reserve requirements. The Board of Governors of the Federal Reserve System is responsible for the discount rate and reserve requirements, and the Federal Open Market Committee is responsible for open market operations. Using the three "tools"..."

BLAH BLAH BLAH... It goes on from there... But CV is a quick study... I quickly understood that in creating policy, it uses "three tools"...

I don't have time for a detailed assessment, but let's examine ONE of those tools...

Ben Bernanke

Role: Chaiman

Field of Study: The Great Depression

Minor: Helicopter Maintenance

Here is a sample of the body of economic work (formerly at Princeton)...

Question: If ever you became FED CHAIRMAN, what would be your stance on the supply of money?

Explain your "toolbox" for such a policy maneuver...

Extrapolate...

Can you illustrate a mechanism you'd use to accomplish such an complicated agenda?

And the "mechanisms" of your colleagues?

There are rumors that there are others (such as the 'de-facto' leader of the White House economic team - de-facto because he's the only one left not named TREASURY SECRETARY), that would covet the job of Fed Chairman... Can you explain, or illustrate why you're more capable than he? (it is acceptable to use his responses to exam questions as evidence for your claim)...

Evidence submitted:

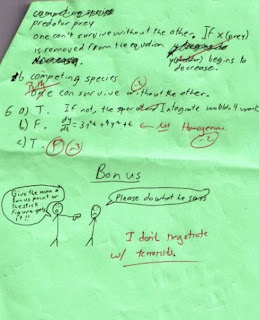

Solve the following two problems...

OK... You're hired... And I'm sure you're going to do a fine job... But please... All your work seems to be in the realm of PhD wizardry... How in the world are you ever going to explain the complex details of your inner workings to your boss, and the people you're appointed to serve?...

And if they STILL don't get it?... I mean, I know people are STUPID... But some of them possess "street smarts"... Some just simply KNOW when they're being lied to... It's a characteristic that has been developed in human evolution... It's evolved from the PREDATOR/PREY symbiosis... That might be something to overcome...

How would you deal with it?

258 comments:

«Oldest ‹Older 201 – 258 of 258 Newer› Newest»-

karen

said...

-

-

August 10, 2010 at 2:19 PM

-

B22

said...

-

-

August 10, 2010 at 2:19 PM

-

karen

said...

-

-

August 10, 2010 at 2:20 PM

-

karen

said...

-

-

August 10, 2010 at 2:21 PM

-

arbitrage789

said...

-

-

August 10, 2010 at 2:22 PM

-

B22

said...

-

-

August 10, 2010 at 2:22 PM

-

Leftback

said...

-

-

August 10, 2010 at 2:23 PM

-

Helicopter Ben

said...

-

-

August 10, 2010 at 2:24 PM

-

karen

said...

-

-

August 10, 2010 at 2:25 PM

-

AmenRa

said...

-

-

August 10, 2010 at 2:25 PM

-

I-Man

said...

-

-

August 10, 2010 at 2:26 PM

-

Leftback

said...

-

-

August 10, 2010 at 2:35 PM

-

Mannwich

said...

-

-

August 10, 2010 at 2:41 PM

-

Leftback

said...

-

-

August 10, 2010 at 2:45 PM

-

Leftback

said...

-

-

August 10, 2010 at 2:47 PM

-

I-Man

said...

-

-

August 10, 2010 at 2:50 PM

-

I-Man

said...

-

-

August 10, 2010 at 2:52 PM

-

Leftback

said...

-

-

August 10, 2010 at 2:54 PM

-

Leftback

said...

-

-

August 10, 2010 at 2:59 PM

-

CV

said...

-

-

August 10, 2010 at 2:59 PM

-

CV

said...

-

-

August 10, 2010 at 3:01 PM

-

Lord Blankfi

said...

-

-

August 10, 2010 at 3:02 PM

-

arbitrage789

said...

-

-

August 10, 2010 at 3:02 PM

-

CV

said...

-

-

August 10, 2010 at 3:07 PM

-

If I were Karen

said...

-

-

August 10, 2010 at 3:21 PM

-

Leftback

said...

-

-

August 10, 2010 at 3:22 PM

-

Nic

said...

-

-

August 10, 2010 at 3:22 PM

-

Nic

said...

-

-

August 10, 2010 at 3:24 PM

-

B22

said...

-

-

August 10, 2010 at 3:26 PM

-

CV

said...

-

-

August 10, 2010 at 3:26 PM

-

CV

said...

-

-

August 10, 2010 at 3:28 PM

-

CV

said...

-

-

August 10, 2010 at 3:28 PM

-

karen

said...

-

-

August 10, 2010 at 3:30 PM

-

B22

said...

-

-

August 10, 2010 at 3:30 PM

-

karen

said...

-

-

August 10, 2010 at 3:30 PM

-

karen

said...

-

-

August 10, 2010 at 3:31 PM

-

karen

said...

-

-

August 10, 2010 at 3:31 PM

-

karen

said...

-

-

August 10, 2010 at 3:33 PM

-

Leftback

said...

-

-

August 10, 2010 at 3:34 PM

-

Colin

said...

-

-

August 10, 2010 at 3:36 PM

-

CV

said...

-

-

August 10, 2010 at 3:39 PM

-

Leftback

said...

-

-

August 10, 2010 at 3:44 PM

-

karen

said...

-

-

August 10, 2010 at 3:45 PM

-

Leftback

said...

-

-

August 10, 2010 at 3:50 PM

-

karen

said...

-

-

August 10, 2010 at 3:53 PM

-

Marty

said...

-

-

August 10, 2010 at 3:56 PM

-

CV

said...

-

-

August 10, 2010 at 3:56 PM

-

Leftback

said...

-

-

August 10, 2010 at 3:59 PM

-

karen

said...

-

-

August 10, 2010 at 4:01 PM

-

karen

said...

-

-

August 10, 2010 at 4:01 PM

-

CV

said...

-

-

August 10, 2010 at 4:03 PM

-

CV

said...

-

-

August 10, 2010 at 4:03 PM

-

B22

said...

-

-

August 10, 2010 at 4:08 PM

-

Leftback

said...

-

-

August 10, 2010 at 4:11 PM

-

karen

said...

-

-

August 10, 2010 at 4:14 PM

-

karen

said...

-

-

August 10, 2010 at 4:19 PM

-

Robert Reich

said...

-

-

August 10, 2010 at 4:21 PM

-

CV

said...

-

-

August 10, 2010 at 4:29 PM

«Oldest ‹Older 201 – 258 of 258 Newer› Newest»WASHINGTON (MarketWatch) -- Federal Reserve policymakers on Tuesday decided to take a small easing step given that the recovery is likely to be more modest in the near term than had been expected. The Federal Open Market Committee announced that it would reinvest maturing mortgage-backed securities back into the market so that its balance sheet does not shrink. Fed watchers described this as a symbolic move designed to show concern with the outlook. As expected, the Fed kept its benchmark interest rate at a record low level. The central bank made no changes to the key pledge to keep rates "exceptionally low" for an "extended period." Thomas Hoenig, the president of the Kansas City Federal Reserve Bank, dissented for the fifth straight meeting in favor of getting rid of the "extended period" pledge. He also said he did not support reinvesting MBS securities.

DL,

yeah, very fair point, inflationists and deflationists alike grab whatever prices fit the thesis, but price changes are just effects of inflation or deflation. I've at least tried to stay consistent in defining what I actually think deflation is, though my def. comes back to what money supply + credit is doing, and has nothing at all to do with prices.

uup at low of day, basically.. alaidi tweets:

balance sheet unchanged, but will REINVEST the PRINCIPAL PMTS from Agenchy debt; that's ONE FORM OF QE hurting $USDX $$

dollar down.. gold up.. rolling my eyes.

B22,

“…stay consistent in defining what I actually think deflation is, though my def. comes back to what money supply + credit is doing”

Fair enough. But it still has to be manifest in some way that is quantifiable.

"Fed watchers described this as a symbolic move designed to show concern with the outlook."

lmao

I wish I could make this stuff up myself.

alright all, enjoy the rest of the day, I promised myself I'd jet after the big drama unfolded because I just don't have it in me to listen to all the madness of what it all "means"

why try to interpret their talky talk when we've got a tape to read.

QE lite. Still hedging our fixed income positions. Stopped out of gold and yen shorts for a small gain.

Risk-on move will see rotation out of Treasuries into equities again before long. BUCKY taking a predicable tumble from here, but he will be back. Gold is off again, and perhaps this is its last rally for the year.

Even in small ways, I want to f**k you over, SAVERS. Got that?

alaidi

Despite stocks' comeback, YEN IS HOLDING STEADY because traders are BUSY SELLING $USDX across the board due to YIELDS BLOODSHED $TNX $$

It's going to be hard on the 10yr on its auction day.

Fuck Bernanke... Fuck the Fed... Fuck them ALL.

Ahh...

That feels better.

Now back to trading.

15y mortgage now 3.96%. Not really helpful for price discovery but John Q is going to love the refi and HELOC aspects of this.

Sticking with the short of the long end into the auctions.

Portfolio up. Hedges down. It happens. BUCKY being hammered.

Hard to see what could happen that could benefit Treasuries from here outside of nuclear conflict or return of mark-to-market accounting....

Going green!

Taking profits in long Treasuries here. This feels unsustainable.

Do you see the intent? Drive down yields, debase dollars and propel investors into risky assets.

We will see this play out in the next few days. Mini melt-up possible.

I see the intent...

But the Fed needs some time In Tent.

I dont even have the motivation to trade this shit.

Have fun in the nuthouse.

LOL.

What happened to the icons?

Life without Karen's icon is... less stimulating.

The other problem with not having icons, is that you don't know who's who.

For example, I'm not really Leftback

"What happened to the icons?"

Government cutbacks... to repair the deficit...

Either that, or they decided to take a Spanish vacation...

Damn cutbacks. Even at GS.

If this keeps up, I'm going to have to cancel my subscription.

@DL

prices were about to DOUBLE anyway...

If I were Karen, I'd have a thing or two to say to Leftback.

My short position in the long bond is almost green.

Isn't it a shame you can't see my rooster today?

My short of the 5y was blown out.

mrtopstep

$ES_F #futures not happy w/after that flop bulls must protect 1115 area or further downside??? $GS sold 300 1117 area

Crude 1hr bear flag

AUDJPY 240min wedge breaking down

all looks like downside pressure to me

I've not yet looked into this but regarding:

"15y mortgage now 3.96%. Not really helpful for price discovery but John Q is going to love the refi and HELOC aspects of this"

I got this note yesterday:

Please take the time to read the enclosed video as it will have a direct impact on any of your clientele looking to do an FHA purchase or refinance mortgage effective September 7th, 2010. Effective September 7th, the FHA “up front” mortgage insurance (MIP) will go down to 1% (from 2.25%) which will create less up front refinancing for your clients (a good thing). However, the monthly “MI” factor (PMI as it’s more commonly referred to) will go up from .55% to .85-.90% (a VERY bad thing). In essence, monthly payments effective September 7th will go up for all FHA clients even with the reduced up-front costs.

@Nic

Agreed...

I'm starting to see patterns the would lead to "covering" the 1070 gap area TOUT DE SUITE... (within a week or so)...

A perfect setup to GAME opex week next week...

@b22

It's time for one of those little cabins...

Hell... it was good enough for Abe Lincoln...

INTC got downgraded... just checked the chart.. bullish? not.

Abe's cool, but I sort of envisioned a life more like Travis from the 1st Old Yeller movie, just so long as I don't catch any hydraphoby.

BreakingNews

House passes $26 billion bill Democrats say would save jobs of more than 300,000 teachers, other public service workers http://bit.ly/c34arr

ha! fed and congress fighting over who puts last nail in dollar coffin..

Ben.. you'll have me sobbing.. no mention of OY please..

alaidi

Avoid aggressive $GBPUSD ahead of tomorrow's BoE inflation report, which may downgrade Econ outlook as all past 3 reports have done $$

There, there, Karen, you can cry on my shoulder....

POOR BUCKY.

Rosie's 1-handle looking better and better...

I was almost going to do an "Ol Yeller" thread the other week...

Anyway... i don't know if I-Man already posted this, but I just ran across the latest Marty A...

http://www.martinarmstrong.org/economic_projections.htm

Yields rising into the close. OUR HEDGE IS GREEN.

Some of you have questioned LB's sanity but his position is up.

We unloaded some bonds, the long bond has had a great run.

What a very odd market.

tomorrows fun (and M reports before the open.. )

7:00 AM MBA Purchase Applications

8:30 AM Trade Balance

10:30 AM Crude Inventories

1:00 PM Ten Year Note Auction

2:00 PM Treasury Budget

If you are here, tomorrow will be fun, Karen...

well, i'll be here unless a great white chomps me this afternoon.. : )

CV, You and I would get along.

Great White

http://www.youtube.com/watch?v=8SutpPadgXM&feature=fvw

Mmm, tasty snack... seriously, do be careful...

Bonds have to sell off into the auction, so a risk-on day or two seems almost a certainty. Do we have an appointment with 1135-1150?

LB thinks so. The end of the month will be the time to enter the juiciest of short positions, ahead of the return of big money from the beach.

For now we can monitor DXY and AUD and watch carefully....

a close under today's open suits me.. would love a surprise kraken visit.. : )

CV @ 3:56.. i'll file that vid under obnoxious!

@karen

You were the one who brought up the subject of "chomping" & Great White honey...

not me...

Better hope the great white doesn't eat the kracken...

Old yeller, yeah, super sad movie, but a great movie though imo.

No kraken this week.

It will be a while before we see Karen's Top again, and when we do, it may be a very rapid fly-by on the way down.

Watch the buck.

ben! it's a novel !! were you ever a 5th or sixth grader ? or did you skip those grades : )

the bill is paid for ???

http://www.youtube.com/watch?v=RZRqraHfYIs

several states are looking at shorter school weeks, etc.. sorry! that has already happened..

We have to "invest" in education.

@Robert Reich

Ben Franklin barely went to school...

And here's Ghandi on 'education"

http://www.infed.org/thinkers/et-gand.htm

And while we're at it... here's PINK FLOYD on education...

http://www.youtube.com/watch?v=d0y3jCbDv08&feature=related

Post a Comment