Ok, so here we are... NFP day...

A Hard Job is Good to find (wait, did I get that right)?

Whaddya say, MAE?

What are all supposed to be waiting for again? Oh yeah, If I recollect, it goes something like...

A) If the number comes in hot, the stock market goes up

B) If the number comes in cold, QE is assured, so the stock market goes up

C) If the number comes in "meh", that's considered goldilocks, so the stock market goes up

Of course, we all know it has nothing to do with actual PEOPLE, or JOBS... Just those who profit at the expense of others...

Tell them they need to SUCK IT UP

Let them eat OKRA cake

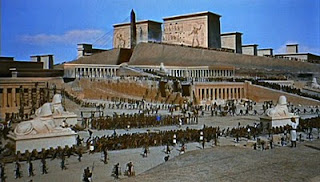

"Down into the never-ending valley of toil and agony, stretching mile after mile, an inferno of mud-soaked bodies, where the treaders' feet churn clay and straw into the mixture for Pharaoh's bricks, and everywhere the lash of watchful taskmasters, ready to sting the backs of the weary.

"Blades chopping straw... mattocks chopping clay, a ceaseless cycle of unending drudgery. From the mixing feet of treaders to the pouring hands of brick molders, moves the constant stream of mud, the lowly seed of tall cities. Day after day, year after year, century after century, bondage without rest, toil without reward. These are the children of misery, the afflicted, the hopeless, the oppressed." - The Ten Commandments - 1956

Not plussed about the toils of every day slaves, here's what a modern day PHARAOH had to say about the world this morning... (well actually, I'd characterize him more of a DATHAN type, but we'll get to that later)...

Markets: Very Big Multithreaded Software Apps That Crash

Excerpt: "Our stock markets now behave no differently than a giant multithreaded software application."

So, Mr. "Do you want to be right, or make money" "Wall Streeter who Blogs"... assuming you count yourself in the "I want to make money" crowd, I suppose you consider yourself a type who collects small gold coins from PHARAOH to keep an eye on the SLAVES working in the mudpits, and assure the building of Goshen goes on...

Well all I can say is "congratulations" on your promotion from TREADER, to TRADER...

But remember What Moses said to Pharaoh:

"The city is made of bricks. The strong make many, the starving make few, the dead make none."

277 comments:

«Oldest ‹Older 1 – 200 of 277 Newer› Newest»-

Bruce in Tennessee

said...

-

-

October 8, 2010 at 8:06 AM

-

CV

said...

-

-

October 8, 2010 at 8:13 AM

-

Bruce in Tennessee

said...

-

-

October 8, 2010 at 8:16 AM

-

Bruce in Tennessee

said...

-

-

October 8, 2010 at 8:28 AM

-

Jennifer

said...

-

-

October 8, 2010 at 8:28 AM

-

CV

said...

-

-

October 8, 2010 at 8:34 AM

-

Anonymous

said...

-

-

October 8, 2010 at 8:38 AM

-

CV

said...

-

-

October 8, 2010 at 8:43 AM

-

spoonman

said...

-

-

October 8, 2010 at 8:50 AM

-

72bat

said...

-

-

October 8, 2010 at 8:51 AM

-

Anonymous

said...

-

-

October 8, 2010 at 8:51 AM

-

CV

said...

-

-

October 8, 2010 at 8:52 AM

-

Jennifer

said...

-

-

October 8, 2010 at 8:52 AM

-

spoonman

said...

-

-

October 8, 2010 at 8:54 AM

-

mcHAPPY

said...

-

-

October 8, 2010 at 8:58 AM

-

Anonymous

said...

-

-

October 8, 2010 at 9:15 AM

-

CV

said...

-

-

October 8, 2010 at 9:16 AM

-

Anonymous

said...

-

-

October 8, 2010 at 9:24 AM

-

karen

said...

-

-

October 8, 2010 at 9:28 AM

-

karen

said...

-

-

October 8, 2010 at 9:31 AM

-

Bruce in Tennessee

said...

-

-

October 8, 2010 at 9:33 AM

-

Anonymous

said...

-

-

October 8, 2010 at 9:33 AM

-

CV

said...

-

-

October 8, 2010 at 9:34 AM

-

karen

said...

-

-

October 8, 2010 at 9:34 AM

-

CV

said...

-

-

October 8, 2010 at 9:39 AM

-

karen

said...

-

-

October 8, 2010 at 9:42 AM

-

CV

said...

-

-

October 8, 2010 at 9:43 AM

-

CV

said...

-

-

October 8, 2010 at 9:46 AM

-

CV

said...

-

-

October 8, 2010 at 9:48 AM

-

karen

said...

-

-

October 8, 2010 at 9:49 AM

-

AmenRa

said...

-

-

October 8, 2010 at 9:49 AM

-

karen

said...

-

-

October 8, 2010 at 9:52 AM

-

CV

said...

-

-

October 8, 2010 at 9:52 AM

-

CV

said...

-

-

October 8, 2010 at 9:53 AM

-

karen

said...

-

-

October 8, 2010 at 9:56 AM

-

karen

said...

-

-

October 8, 2010 at 9:58 AM

-

karen

said...

-

-

October 8, 2010 at 9:59 AM

-

karen

said...

-

-

October 8, 2010 at 10:01 AM

-

CV

said...

-

-

October 8, 2010 at 10:01 AM

-

Bruce in Tennessee

said...

-

-

October 8, 2010 at 10:03 AM

-

karen

said...

-

-

October 8, 2010 at 10:05 AM

-

CV

said...

-

-

October 8, 2010 at 10:06 AM

-

Bruce in Tennessee

said...

-

-

October 8, 2010 at 10:07 AM

-

karen

said...

-

-

October 8, 2010 at 10:10 AM

-

karen

said...

-

-

October 8, 2010 at 10:11 AM

-

CV

said...

-

-

October 8, 2010 at 10:12 AM

-

karen

said...

-

-

October 8, 2010 at 10:13 AM

-

Bruce in Tennessee

said...

-

-

October 8, 2010 at 10:13 AM

-

Bruce in Tennessee

said...

-

-

October 8, 2010 at 10:13 AM

-

karen

said...

-

-

October 8, 2010 at 10:20 AM

-

karen

said...

-

-

October 8, 2010 at 10:21 AM

-

CV

said...

-

-

October 8, 2010 at 10:23 AM

-

karen

said...

-

-

October 8, 2010 at 10:28 AM

-

karen

said...

-

-

October 8, 2010 at 10:36 AM

-

karen

said...

-

-

October 8, 2010 at 10:38 AM

-

karen

said...

-

-

October 8, 2010 at 10:40 AM

-

CV

said...

-

-

October 8, 2010 at 10:40 AM

-

CV

said...

-

-

October 8, 2010 at 10:49 AM

-

CV

said...

-

-

October 8, 2010 at 10:55 AM

-

CV

said...

-

-

October 8, 2010 at 10:57 AM

-

CV

said...

-

-

October 8, 2010 at 10:59 AM

-

CV

said...

-

-

October 8, 2010 at 11:07 AM

-

karen

said...

-

-

October 8, 2010 at 11:15 AM

-

karen

said...

-

-

October 8, 2010 at 11:18 AM

-

CV

said...

-

-

October 8, 2010 at 11:22 AM

-

karen

said...

-

-

October 8, 2010 at 11:23 AM

-

mcHAPPY

said...

-

-

October 8, 2010 at 11:24 AM

-

CV

said...

-

-

October 8, 2010 at 11:25 AM

-

karen

said...

-

-

October 8, 2010 at 11:27 AM

-

CV

said...

-

-

October 8, 2010 at 11:27 AM

-

karen

said...

-

-

October 8, 2010 at 11:46 AM

-

CV

said...

-

-

October 8, 2010 at 11:49 AM

-

CV

said...

-

-

October 8, 2010 at 11:49 AM

-

karen

said...

-

-

October 8, 2010 at 11:52 AM

-

AmenRa

said...

-

-

October 8, 2010 at 11:54 AM

-

CV

said...

-

-

October 8, 2010 at 11:57 AM

-

karen

said...

-

-

October 8, 2010 at 11:57 AM

-

karen

said...

-

-

October 8, 2010 at 12:00 PM

-

CV

said...

-

-

October 8, 2010 at 12:02 PM

-

CV

said...

-

-

October 8, 2010 at 12:03 PM

-

CV

said...

-

-

October 8, 2010 at 12:04 PM

-

karen

said...

-

-

October 8, 2010 at 12:09 PM

-

karen

said...

-

-

October 8, 2010 at 12:13 PM

-

karen

said...

-

-

October 8, 2010 at 12:15 PM

-

CV

said...

-

-

October 8, 2010 at 12:16 PM

-

karen

said...

-

-

October 8, 2010 at 12:16 PM

-

karen

said...

-

-

October 8, 2010 at 12:18 PM

-

karen

said...

-

-

October 8, 2010 at 12:19 PM

-

karen

said...

-

-

October 8, 2010 at 12:20 PM

-

karen

said...

-

-

October 8, 2010 at 12:22 PM

-

karen

said...

-

-

October 8, 2010 at 12:25 PM

-

CV

said...

-

-

October 8, 2010 at 12:31 PM

-

CV

said...

-

-

October 8, 2010 at 12:32 PM

-

CV

said...

-

-

October 8, 2010 at 12:34 PM

-

karen

said...

-

-

October 8, 2010 at 12:40 PM

-

karen

said...

-

-

October 8, 2010 at 12:49 PM

-

Anonymous

said...

-

-

October 8, 2010 at 12:50 PM

-

karen

said...

-

-

October 8, 2010 at 12:55 PM

-

karen

said...

-

-

October 8, 2010 at 12:56 PM

-

AmenRa

said...

-

-

October 8, 2010 at 12:57 PM

-

Bruce in Tennessee

said...

-

-

October 8, 2010 at 12:58 PM

-

AmenRa

said...

-

-

October 8, 2010 at 1:01 PM

-

karen

said...

-

-

October 8, 2010 at 1:07 PM

-

I-Man

said...

-

-

October 8, 2010 at 1:10 PM

-

I-Man

said...

-

-

October 8, 2010 at 1:11 PM

-

Bruce in Tennessee

said...

-

-

October 8, 2010 at 1:15 PM

-

Bruce in Tennessee

said...

-

-

October 8, 2010 at 1:17 PM

-

I-Man

said...

-

-

October 8, 2010 at 1:21 PM

-

karen

said...

-

-

October 8, 2010 at 1:24 PM

-

I-Man

said...

-

-

October 8, 2010 at 1:25 PM

-

karen

said...

-

-

October 8, 2010 at 1:27 PM

-

Bruce in Tennessee

said...

-

-

October 8, 2010 at 1:28 PM

-

karen

said...

-

-

October 8, 2010 at 1:28 PM

-

karen

said...

-

-

October 8, 2010 at 1:31 PM

-

Leftback

said...

-

-

October 8, 2010 at 1:31 PM

-

Bruce in Tennessee

said...

-

-

October 8, 2010 at 1:33 PM

-

Leftback

said...

-

-

October 8, 2010 at 1:33 PM

-

Jennifer

said...

-

-

October 8, 2010 at 1:47 PM

-

karen

said...

-

-

October 8, 2010 at 1:47 PM

-

karen

said...

-

-

October 8, 2010 at 1:54 PM

-

arbitrage789

said...

-

-

October 8, 2010 at 1:56 PM

-

Leftback

said...

-

-

October 8, 2010 at 1:56 PM

-

Leftback

said...

-

-

October 8, 2010 at 1:57 PM

-

karen

said...

-

-

October 8, 2010 at 1:59 PM

-

karen

said...

-

-

October 8, 2010 at 2:02 PM

-

karen

said...

-

-

October 8, 2010 at 2:03 PM

-

arbitrage789

said...

-

-

October 8, 2010 at 2:04 PM

-

karen

said...

-

-

October 8, 2010 at 2:09 PM

-

karen

said...

-

-

October 8, 2010 at 2:12 PM

-

arbitrage789

said...

-

-

October 8, 2010 at 2:16 PM

-

I-Man

said...

-

-

October 8, 2010 at 2:17 PM

-

I-Man

said...

-

-

October 8, 2010 at 2:18 PM

-

karen

said...

-

-

October 8, 2010 at 2:19 PM

-

Jennifer

said...

-

-

October 8, 2010 at 2:20 PM

-

arbitrage789

said...

-

-

October 8, 2010 at 2:22 PM

-

Leftback

said...

-

-

October 8, 2010 at 2:22 PM

-

karen

said...

-

-

October 8, 2010 at 2:24 PM

-

Leftback

said...

-

-

October 8, 2010 at 2:24 PM

-

arbitrage789

said...

-

-

October 8, 2010 at 2:27 PM

-

I-Man

said...

-

-

October 8, 2010 at 2:28 PM

-

I-Man

said...

-

-

October 8, 2010 at 2:29 PM

-

karen

said...

-

-

October 8, 2010 at 2:31 PM

-

arbitrage789

said...

-

-

October 8, 2010 at 2:35 PM

-

Leftback

said...

-

-

October 8, 2010 at 2:39 PM

-

I-Man

said...

-

-

October 8, 2010 at 2:40 PM

-

arbitrage789

said...

-

-

October 8, 2010 at 2:40 PM

-

Leftback

said...

-

-

October 8, 2010 at 2:43 PM

-

arbitrage789

said...

-

-

October 8, 2010 at 2:44 PM

-

karen

said...

-

-

October 8, 2010 at 2:47 PM

-

Leftback

said...

-

-

October 8, 2010 at 2:47 PM

-

karen

said...

-

-

October 8, 2010 at 2:48 PM

-

M C Hammer

said...

-

-

October 8, 2010 at 2:49 PM

-

Leftback

said...

-

-

October 8, 2010 at 2:50 PM

-

karen

said...

-

-

October 8, 2010 at 2:51 PM

-

arbitrage789

said...

-

-

October 8, 2010 at 2:54 PM

-

karen

said...

-

-

October 8, 2010 at 2:54 PM

-

Leftback

said...

-

-

October 8, 2010 at 2:58 PM

-

karen

said...

-

-

October 8, 2010 at 2:58 PM

-

Leftback

said...

-

-

October 8, 2010 at 2:59 PM

-

I-Man

said...

-

-

October 8, 2010 at 3:01 PM

-

karen

said...

-

-

October 8, 2010 at 3:01 PM

-

karen

said...

-

-

October 8, 2010 at 3:02 PM

-

Jennifer

said...

-

-

October 8, 2010 at 3:04 PM

-

arbitrage789

said...

-

-

October 8, 2010 at 3:04 PM

-

Jennifer

said...

-

-

October 8, 2010 at 3:05 PM

-

I-Man

said...

-

-

October 8, 2010 at 3:05 PM

-

I-Man

said...

-

-

October 8, 2010 at 3:06 PM

-

Leftback

said...

-

-

October 8, 2010 at 3:06 PM

-

karen

said...

-

-

October 8, 2010 at 3:06 PM

-

CV

said...

-

-

October 8, 2010 at 3:06 PM

-

karen

said...

-

-

October 8, 2010 at 3:08 PM

-

CV

said...

-

-

October 8, 2010 at 3:08 PM

-

Leftback

said...

-

-

October 8, 2010 at 3:08 PM

-

I-Man

said...

-

-

October 8, 2010 at 3:09 PM

-

karen

said...

-

-

October 8, 2010 at 3:10 PM

-

CV

said...

-

-

October 8, 2010 at 3:10 PM

-

karen

said...

-

-

October 8, 2010 at 3:11 PM

-

karen

said...

-

-

October 8, 2010 at 3:12 PM

-

karen

said...

-

-

October 8, 2010 at 3:14 PM

-

CV

said...

-

-

October 8, 2010 at 3:14 PM

-

CV

said...

-

-

October 8, 2010 at 3:16 PM

-

karen

said...

-

-

October 8, 2010 at 3:16 PM

-

CV

said...

-

-

October 8, 2010 at 3:17 PM

-

karen

said...

-

-

October 8, 2010 at 3:19 PM

-

karen

said...

-

-

October 8, 2010 at 3:21 PM

-

CV

said...

-

-

October 8, 2010 at 3:21 PM

-

karen

said...

-

-

October 8, 2010 at 3:21 PM

-

CV

said...

-

-

October 8, 2010 at 3:23 PM

-

Leftback

said...

-

-

October 8, 2010 at 3:24 PM

-

karen

said...

-

-

October 8, 2010 at 3:25 PM

-

I-Man

said...

-

-

October 8, 2010 at 3:26 PM

-

CV

said...

-

-

October 8, 2010 at 3:28 PM

-

karen

said...

-

-

October 8, 2010 at 3:28 PM

-

CV

said...

-

-

October 8, 2010 at 3:28 PM

-

CV

said...

-

-

October 8, 2010 at 3:30 PM

-

karen

said...

-

-

October 8, 2010 at 3:30 PM

-

karen

said...

-

-

October 8, 2010 at 3:31 PM

-

karen

said...

-

-

October 8, 2010 at 3:32 PM

-

karen

said...

-

-

October 8, 2010 at 3:32 PM

-

karen

said...

-

-

October 8, 2010 at 3:33 PM

«Oldest ‹Older 1 – 200 of 277 Newer› Newest»http://www.cnbc.com/id/39532389/

Private-Sector Hiring Falters; Planned Layoffs Up 7%

"Private-sector job growth tumbled by 39,000 from August to September, a considerably worse number than analysts had expected and indicative that the employment market is far from recovery, according to the ADP.

The ADP National Employment report, compiled with Marcoeconomic Advisors, was projected to show a gain of 20,000 for the month.

"It's a disappointing number but it's not unexpected," Joel Prakken, chairman of Macroeconomic Advisors, told CNBC. "GDP growth has slowed to below the growth rate of productivity and it's inevitable that you'd have this deceleration in jobs."

....If that was truly the case, then why did everyone think there would be an increase in private sector employment???

Logic sometimes eludes me, or something....

...all ginned up on hope...

AGAIN

http://www.bloomberg.com/news/2010-10-07/china-sold-a-net-24-3-billion-of-japanese-debt-in-august-ministry-says.html

China Sold Most Japan Debt on Record in August

"China sold a record amount of Japanese debt in August, snapping a seventh-straight month of purchases.

China cut Japanese debt holdings by a net 2.02 trillion yen ($24.5 billion), the Ministry of Finance said today in Tokyo, the biggest monthly sale in data going back to 2005. The larger nation bought a record 735.2 billion yen of Japanese debt in May and 1.04 trillion yen of the securities the following two months.

“Today’s ministry report suggests China had purchased yen- denominated assets not to diversify their foreign reserves but to temporarily escape from the unstable financial situation in Europe,” Yasunari Ueno, chief market economist at Mizuho Securities Co. in Tokyo, wrote in a report today."

...Or, as my wife opined this morning, it may mean that China has now, by its massive purchase of other debt, become the de facto controller of the value of the world's currencies...if they desire to....

...?Found this too:

http://www.washingtonpost.com/wp-dyn/content/article/2010/10/07/AR2010100704523.html

IMF chief says China, others may see currency as a 'weapon'

...So maybe my wife gets it right...(as usual)...but I did like the whine at the end of this story:

"U.S. Treasury Secretary Timothy F. Geithner urged the fund this week to become more active in resolving the issue and said it made little sense to allow emerging nations such as China a greater say in IMF affairs if they were not going to play by the same rules as other leading economic nations."

...The guy who won't pay taxes and can't sell his house says China is not playing FAIR! Imagine that...I suspect he'll tell his momma..

Karen - re: wine, too late. Took an amazing 10th anniversary trip last year to Sonoma, among other places. What was a small diversion before is now a lovely, if expensive, hobby. (Maybe like my trading?)

I haven't been able to watch the Bass vids yet and the kids have plans for me today. I hate it when the futs are down, but so is fair value.

Payrolls Plunge By 95K, Unemployment Rate 9.6%

dammit CV-

quit making your posts so interesting so that I have to read them-

and Mae West- not bad

U-6 to 17.1% from 16.7%... lol (or "col")

Sounds like a great report to me. Buy 'em.

Happy Birthday, AT!

enjoy vegas

best of luck at the tables

the UE figure holds steady-

the new unemployed match those that give up and drop off the rolls

let it ride!

Happy Birthday Andy! Watch out for that hotel death ray! If you smell your hair burning, it just might be...

Happy birthday Andy.

Wow on the EUR/USD chart from the last 2.5 hours.

Jon Najarian-

the market remains supported by the quantitative easing fever that has spread to central bankers around the world. “It’s the hand under the market,” he says.

Thanks Jon

The Chinese are not ROR about this...

Chinese dissident Liu wins Nobel Peace Prize

http://news.yahoo.com/s/ap/nobel_peace_prize

"Chinese state media immediately blacked out the news and Chinese government censors blocked Nobel Prize reports from Internet websites. China declared the decision would harm its relations with Norway — and the Nordic country responded that was a petty thing for a world power to do."

Easy solution...

Just give it to Barack Obama again so we can go back to ROR...

what's the consensus?

the Fed is boxed in- but I still don't see them going crazy QE2 w/ trillions-

my expectation is for very modest action

good morning, all! (CV, loved that last quote.. "The City is made of bricks.." I never heard that before..) Ahab @ 9:15, I kno right?! Jennifer, haven't watched the Bass videos yet either.. my macbook wouldn't stream and I have yet to get back to them. As long as you don't drink the wine, you should be okay! : )

anyone up for some YCS.. don't buy above 16, tho : )

U6 unemployment - people who are working part-time, have given up or are otherwise underemployed - is at 17.1%, the highest level since October 2009.

...As CV stated earlier...and wages per hour increased 0.

it will be interesting to see how this plays out today-

got things to do this morning-

will check in later

@ahab

QE2 effects

20 S&P points; a half trillion

DOW 36,000; $5 trillion

Getting rid of Bernanke and the whole damn crew; PRICELESS

I must bring your attention once again to HYG:LQD.. still looking weakie..

Weakie?

wikki wikki wikki wikki

http://www.youtube.com/watch?v=4hXPu32FuE4&feature=related

never heard that tune in my life!!

all the rage back in the OLD SKOOL DAZE...

Just ask Amen...

Alright, is it just me?...

But now that the big ol suspense is gone for the last NFP before the...

drumroll...

ELECTIONS

Does it feel like the market is just going to hang around and do nothing today?

OPEX next week...

One and a half "freakout" days to shake the tree, then pin the number next Friday...

Maybe they'll tank the week after next...

This is getting boring...

Of course there are all those FABRICATED EARNINGS REPORTS to pour thru...

Like none of that is already "priced in" anyway, and only serves as a little doctors tomohawk chop to the knee funny bone...

this is something: http://www.businessinsider.com/entrepreneur-takes-on-apple-and-wins-625mm-2010-10

Wild guess (didn't click the link yet). Is that Jam On It by Newcleus?

As the Star Wars guys always said just before the bottom dropped out: "I've got a bad feeling about this..."

http://www.oftwominds.com/blogoct10/look-out-below10-10.html

Why the hell do the doctors bop you on the knee to see if you'll kick anyway?

What if you didn't? (Wouldn't that mean that you were paralyzed and therefore wouldn't have been able to walk in to the office in the first place)...

I mean, C'MON MAN... What are we paying for here?

Yeah that's it... FREE HEALTH CARE (so the doctor can bop you on the knee with a little toy indian tomohawk)...

Sounds more like another Obama slush fund to me...

By the way... whatever happened to all the $700 billion in TARP money that was (advertised to have been paid back)...

I suppose some of it got blown on trips to Spain & Marthas Vineyard...

@Amen

Yup - "I don't need no fans to cool my amps, I just use my Super breath"...

okay, every one.. drop every thing.. Soros on the currencies:

http://www.ft.com/cms/s/0/f4dd9122-d22a-11df-8fbe-00144feabdc0.html

seriously, this market CANNOT go down so just buy the dips (in gold, that is.)

For you CV.. cuz all you care about are the ELECTIONS and their effect on the market!

http://www.bespokeinvest.com/thinkbig/2010/10/8/dem-turnaround-yet-to-happen.html

and this one has my and CV's stamp of approval!

http://www.businessinsider.com/citi-either-bonds-yields-need-to-rise-or-stocks-need-to-crash-2010-10

@karen

What can I say...

Crappy jobs report... no end in sight to the structural unemployment problem...

VIX drops! equities green!

http://www.epi.org/publications/entry/americas_fiscal_choices

..This is the web broadcast of CR's post of 3 Amigos talking about our fiscal problems...it is worth an eyeball, but it is almost an hour long. Krugman is fascinating to watch squirm and wiggle especially in the last 10 minutes when discussion turns to tax cuts for "the rich"....

oops.. i take that back.. that Citi article does not have my stamp of approval.. sorry.. shoulda read it first!!

@Bruce

there's no possible way i could get thru an hour of watching krugman...

Well... maybe...

But the exception would be if Hugh Hendry was on the other side of him giving him a beatdown...

http://www.businessinsider.com/citi-either-bonds-yields-need-to-rise-or-stocks-need-to-crash-2010-10

...I agree too, Karen....

yeah, but the citi article thinks stocks are undervalued:

The recent rebound in equities seems logical enough to us. Valuations look cheap and concerns about a global EPS double dip appear overdone. As for the conundrum shown in Figure 15 (the break-down in the close relationship between equity prices and government bond yields) Citi equity and rate strategists’ forecasts suggest that, partly as a result of QE, bond yields are unsustainably low rather than equity prices unsustainably high. Indeed, our recent analysis shows that previous breakdowns in this relationship have been more often resolved through bonds correcting than equities correcting.

So one of the market's is 'wrong' and it's more likely the bond market, thinks Citi.

but then again, the source, Citi! of course, THEIR stock is undervalued..

I agree with this part...

"Mr. Buckland thinks the divergence is unsustainable and will eventually have to come to an end:"

I don't agree with this...

"Citi's Robert Buckland:

The recent rebound in equities seems logical enough to us. Valuations look cheap and concerns about a global EPS double dip appear overdone. As for the conundrum shown in Figure 15 (the break-down in the close relationship between equity prices and government bond yields) Citi equity and rate strategists’ forecasts suggest that, partly as a result of QE, bond yields are unsustainably low rather than equity prices unsustainably high. Indeed, our recent analysis shows that previous breakdowns in this relationship have been more often resolved through bonds correcting than equities correcting."

What a tool...

Not saying he WON'T be right... Just that he's a tool...

Here's the skinny people (as this tool perceives it)...

- Fed prints money

- money chases RISK assets

- prices inflate

- J6P gets hosed when oil goes to $100 and with his grocery bill

- Fed up citizens write letters to Congress

- Congress, loath to take the blame, calls Bernanke to Hill to testify

- Bernanke says a few words (that sound like Charlie Browns teacher)

- Market gets scared that punch bowl will be taken away

- seeing massive bubble in RISK assets, market corrects

See? Bonds had it right all along!

http://www.zerohedge.com/article/jon-stewart-humor-high-frequency-signing-scandal

Krugman, as always, still thinks we spend the money until "it works"

Although I would have been bored to death to have spent my life as an economist, there is an idea I've recently been toying with...TIMING....

I think, looking back on it, if the government were going to consider massive stimulus, they should have waited until things got worse..another words...start the stimulus, say, about now! Yes, banks would have failed, but what we are doing here is trying to maintain the credit balloon fully inflated as it was in 2007. This means the taxpayer is trying to keep housing up, car manufacturers up, government employees and pensions up, and so forth.

Had real pain ensued you NOW would be better able to target where to spend the money (a rifle not a shotgun) industries we couldn't save would be gone, and the money you spent might make a real and a psychological difference. The way it is, all we've seen is that this was Humpty Dumpty...

going to run...back later, tater...

just noted jjc.. rolling my eyes..

tradefast

SPX has been virtually flat (closing basis) since tuesday - and is virtually flat at the moment - this has got to be some kind of a record

@Bruce

"Krugman, as always, still thinks we spend the money until "it works"

---

I got news for you... In a fractional reserve banking system, the moment "IT WORKS" comes when the bankers convince the sheeple that it's in their best interest (lifestyle wise), to pile on DEBT to their balance sheet...

All the better if they can lever it against mis-priced assets...

That ship has left the barn... People want OUT of debt...

Fractional reserve banking is toast... Therefore - the economy (as we've known it for the last 100 years) is toast...

Hey, but you clowns have a bunch of nobel prizes to can sit around and play with... So you have THAT going for you...

USDA Crop Report 'Shocker' Ripples Through Commodities, Equities

CHICAGO (Dow Jones)--Government forecasters slashed estimates for the U.S. corn harvest Friday, shocking commodity traders and igniting shares of agriculture companies.

PeterUlsteen

All grains limit-up across the board.

SAN FRANCISCO (MarketWatch) -- CarMax Inc. shares jumped 4% to $29.14 on Friday after notching a record high of $29.90 earlier in the trading session. The leading used-car retailer has seen its stock rally 42% in the past year as it has participated in a broader recovery in the auto sector.

".. but it's not my favorite time to invest when the "smart money" is hugely short and the "dumb money" is hugely long. Which is what we have right now in the Nasdaq 100."

http://www.minyanville.com/businessmarkets/articles/nasdaq-100-ndx-rydex-hedge-counter/10/8/2010/id/30463

@karen (10:28)

Perfect... We're so worried about saving the wall street banks we can't feed ourselves...

I can't wait for food & gas prices to triple...

I'm looking forward to see the poor hungry zombies come straggling out to the farm...

I could use a couple of good hands to chop some earth with a mattock...

I'm looking forward to seeing people holding cardboard signs in the middle of GOTHAM that say"

"Will create SIV's for food"...

@karen

All that's happening right now is just setting the stage for a HYPERBOLIC move in hard goods down the line...

- Forget todays grain prices (on news)

- Forget silver & gold prices (on QE2)

We'll get a "deflationary" scare pullback sooner or later (as soon as this little "ginned up" QE2 talk becomes NEWS instead of SPECULATION)...

But here's the dynamic that has changed...

Before, I'd expected HYPERINFLATION to come sometime around the end of this decade... AFTER THE DEFLATION...

Now, I believe it'll all happen sooner...

Next big pullback, and you have to be ALL IN... No more playing around...

You'd better have food, fuel, booze, and handy repair & convenience items stocked up as well...

This move now is telling me NEXT MOVE is going to be the big one...

The Fed is "boxed in"

Bank of America Halts Foreclosures In All 50 States

http://www.zerohedge.com/article/bank-america-halts-foreclosures-all-50-states

Great... Might as well default on credit card payments too...

My point is... What type of "liquidity" situation do banks get in when this news goes viral, and ANYBODY...

I mean ANYBODY, paying on ANY loan, decides... "Hell with it... I won't pay"...

Congrats on the moral hazard you ushered into the White House Mr. President...

I mean... Who in their right mind would pay on a loan right now?

Any type...

- Mortgage

- Unsecured credit card

- Student Loan

James Jones, National Security Adviser, To Resign

http://www.npr.org/blogs/thetwo-way/2010/10/08/130425201/james-jones-national-security-adviser-to-resign

http://www.businessinsider.com/henry-blodget-jim-grant-2010-10

today feels like a hyper-inflation run to me..

yeah - remind me again why it was a bad idea to buy silver coins over the summer...

or is this a short covering induced flame-out?

i just wish i knew what was going on.. so it's great news that BAC is halting foreclosures.. no mtg to pay, more to spend on retail.. but how is this good for the banks?

I see nothing bearish in the charts short term.

U.S. Mint Raises Premiums 33% to Shut Off Physical Demand

http://news.silverseek.com/SilverSeek/1286388589.php

okay, i won't ask any more questions.. i won't ask why TBT is red.. I won't ask while the divergence between stocks and bonds continues unabated..

"but how is this good for the banks?"

it means that QE2 of a half trillion just went to:

QE2 thru infinity for... write a blank check...

businessinsider

October 8, 2010: The Day Agriculture Prices Exploded by @thestalwart http://read.bi/9oyFNx

less than a minute ago via Business Insider

Reply Retweet

AnneMarieTrades

$CAT huge breakout over 80 here folks...in for the run $$

CAT... going to all time high

IBM all time high

MCD all time high

sounds inflationary to me...

oops.. i think it's the algos.. naz up .51, spx .55, dow .55

How long before 2.2x% is seen on the TNX?

I sure wish Israel would nuke Iran or something so we can shoot this market up to 1,200 or 1,300...

This is too boring...

you have to admit this is wild stuff.. $tnx 23.34 today and spx 1165..

CV!! I beg you not to say something like that, even in jest.

What do you expect ANYONE to say in an America that has come down to this...

blog comment

"I have a house up in Washington state with a BAC mortgage which is under water around $100K. I keep paying the mortgage because, well, I agreed to the deal and I do have the income. But these guys are really making it difficult for me. There's only so much financial temptation a man can resist. I could easily purchase another home in the neighborhood (there are many to choose from) for far less money than my current loan balance. Then default on my BAC mortgage, rent out the house and pocket the money, and ride that train for a couple years, probably. Buy gold with the proceeds and pay off the new mortgage with debased dollars. I'm not sure why I don't do this. Poor upbringing, I guess. I blame my parents for instilling honest, middle-class values which are entirely unsuitable for prospering in the current environment."

...and he's RIGHT

Now if he would just rent his house to Peggy Joseph...

We'd come full circle...

If the definition of insanity is making the same mistakes over and over again, then the capital markets are certafiably insane.

http://ibankcoin.com/scott_bleier/2010/10/07/gentle-parabolic-insanity/

more wildness: http://noir.bloomberg.com/apps/news?pid=newsarchive&sid=aULjL5cs.858

Bill Gross: Fed To Buy $100 Billion In Government Debt A Month Until It Hits $1.2 Trillion

The Tepper Rally just got goosed by Bill Gross..

...at which point it will start buying $200 billion a month...

gold and crude are not quite soaring with the market.. maybe that money is more interested in grains and ag.. JFC.. what a mess.

The dollar still has a chance to show some true grit here.. (no youtube, CV!)

All I want to know is, "are we there yet?" whimpering.. not really, LOL.

Just wishing I had been "Smart like Tepper."

(wonder if he stopped paying his mtg, too??)

don't read this for good news:

http://www.epi.org/publications/entry/september_jobs_picture/

The recent divergence began in the early summer of 2010, with the 10 year seemingly signaling more weakness ahead while the equity market is holding strong in positive territory for the year.

How long is it likely to last? Which market is “right?”

As abnormal as this seems, there is some historical precedent: Japan.

http://annaly.com/blog/2010/10/05/ShiftingCorrelations.aspx

"Smart like Tepper"

I will all but guarantee you that within 2 decades, Tepper, Bernanke, Ritholtz, and all the others will be swinging a MATTOCK just like CV...

Maybe I'll sell some "seeds" & moonshine to them for their bags of gold...

OK... so it won't be EXACTLY like that...

But a lot closer than most of the rest of you think right now...

I hate to leave you here...

But I have to run out for about an hour and a half...

I'll catch up for the closing hour...

The negative divergence on the CAT chart is something to behold.. not that it matters..

I feel like this is the flash crash in reverse.. the flash rally..

@ CV(12:02)

Ethics!

That's why western countries are(were) highly regarded in the Emerging Markets by the general public.

I Can

up .63, up .62, up .63

nas, dow, spx

.64/63/.64

yeah, those are human traders aligning the indices..

Karen

I feel you. Nothing worse than watching the market rise on BS.

You better get yur mind right brothers and sisters (Cool Hand Luke)...You love Brother Tepper right (Orwell)...

We are gonna have high church so I expect a lot of Amens and When Brother Tepper passes the plate say, thank you, Brother Tepper for your gift, (You economically amoral, cocksure, flippant rascal, you)

But better come to the computer and put you hands on your touchscreen, cause there is a presence here tonight!

Brother Tepper's Traveling Salvation Show (Diamond)...we are just getting started!!!

...and we all want to thank you Brother Bernanke, for what we are about to receive..

Bruce

LMAO. Hell I may try to take the bottle during communion.

i guess i should stop staring at the 111 gap.. : )

@ I Can

Are we like distant cousins or something?

BTW...

the grains... would hate to be trapped there... wow.

If this is not some kind of top in YM, then so much of my charting method is flat wrong, I might need to consider a different line of work.

IMan:

This was part of my thinking, too, yesterday, when I wondered if massive government intervention can alter TA to some degree. It would seem to me that the "Tepper" response would be yes...

...As for me, I am going hiking later today

I mean, Tepper's thesis was bad news is good (QEII)

Good news is good

...These distortions put the notion of normal eqity evaluation in Rod Serling's Twilight Zone..

Seriously! Read this shit, and try not to vom in your mouth...

http://money.cnn.com/2010/10/08/markets/markets_newyork/index.htm

"Stocks rallied, with the Dow crossing 11,000 for the first time in five months, after a sharp drop in the overall jobs figure in September boosted the chances of stimulus measures from the Federal Reserve."

... As for me, I am going on a long, long, long low tide walk this afternoon.. a good 3 hours.. and i cannot wait!

(I never did get to that watermelon-lime juice in my refrigerator.. wonder if it is still good..)

Makes me want to throw every cent I can into a long USD trade, and go to the beach for the next 3 months.

http://www.bespokeinvest.com/thinkbig/2010/10/8/dow-member-trading-ranges-and-ytd-numbers.html

Pack up the babies

And grab the old ladies

And everyone goes

Cause everyone knows

That Brother Tepper says "It's All Good"

more good stuff at bespoke:

http://www.bespokeinvest.com/thinkbig/2010/10/8/percentage-of-stocks-above-50-day-moving-averages.html

$bkx still red.. who want to be long the weekend? this is gonna be an interesting close.. and FOMC minutes on Tuesday, i believe..

LB has returned from an Out of Pocket experience in DC.

K., I would love to join you for the afternoon, and I'm sure LB and K could make it last 3 hours.

About to leave with the pups. As for me, if everyone is buying into this, I will probably start sticking my toe in, a little at a time...although as Ben so rightly stated we should only invest through thorough analysis, it appears, at least for a short time, that Tepper has figured out the souless thoughts of the Federal Reserve. I don't like it, I think interest rates should rise, but they didn't make me King, so I will trade 'em as I see 'em.

LB doesn't think you short stocks until there are some higher Tsy yields to plough your cash into. That isn't coming around any time soon.

The L-Man has been selling bonds BIG STYLE again this week. We're short the long bond - from now into the auction next Thursday at least.

Interesting who wasn't invited to the party though...poor NFLX, poor THOR...(poorer me.)

it's gonna be a looong weekend, too.. did i mention that $bkx was red ? LOL

amzn wasn't in much of a party mood either.. just those niftly thirty (less the help of kft, bac, jpm, vz, wmt, t, axp...

VIX is finally beginning to show a modicum of complacency.

Who knows? We might even get a 2% decline in the market next week.

Stranger things have happened.

My divvies are more or less oblivious to the index froth....

EEM going vertical. LB is long EEM. heh heh heh

Still, this isn't going to last for ever, eh?

you are out of your mind if you think EEM is going vertical.. hasn't even recouped yesterday's losses..

http://www.businessinsider.com/senator-harry-reid-calls-on-total-foreclosure-halt-in-all-50-states-2010-10

I swear.. everyone will stop paying their mortgages.. the law of unintended consequences..

CMEGroup: Yesterday was a record in trading gold options at the exchange with 102,292 contracts traded

K @ 2:03

And the put/call ratio?

DL, this is all i know from yesterday:

NEW YORK (Market Intellisearch) -- GLD options saw interesting put activity today. A total of 315,488 put and 259,602 call contracts were traded raising a three month record high put volume alert. Today's traded Put/Call ratio is 1.22. There were 1.22 puts traded for each call contract.

as for $vix: Group One's Jamie Tyrrell says there's less need to pay premiums for October futures now that the big job report has been released.

K @ 2:12

So that settles it.

We won't get so much as a 2% correction for the rest of the month.

I get the feeling everyone is scared to short...

Thats got to mean theres some toppage here.

A month ago any weakness would be pounced on...

I'm short... and feeling kinda lonely at the moment.

this will give you SHIVERS and it is the absolute truth from Janet Tavakoli.

http://www.zerohedge.com/article/janet-tavakoli-biggest-fraud-history-capital-markets

I'm keeping you company....to the detriment of my financial well being.

I-Man @ 2:18

I'm short also, although I've got a slightly longer time frame than you do. (I don't go out "flat" every day).

I'm not shorting.

I am sitting on really large cash positions. Larger than normal.

the end of the USA.. you've all heard of this Russian before but he's getting more attention:

http://online.wsj.com/article/SB123051100709638419.html

I just don't see that we can have anything too significant in the way of equity sell-offs until we have the QE announcement, or until we have higher bond yields.

The Tsy market, BUCKY and gold are where we should be focused.

I'm not expecting a massive decline in SPX this month (or this quarter, for that matter).

I just want a 3-4% pullback before moving higher.

This will really irk CV, but word I hear from the Chi is that folks are scared to short ahead of the election, dollar, etc...

So Jah forbid there is any kind of CATARYST that comes outta left field... no one to cover at the lows, means lower lows... sprinkle in some HFT rambo action, and the fed has a real perfect storm on their hands, and bernanke's role is played by george clooney.

Hey, all I want is a hundo down ticks...

DL, all i want is all you want : )

Karen,

Couldn't have said it better myself.

CATARYST

ROR.... we LEARRY are turning Japanese, I-Man !!

Karen,

All I want is a new icon, baby.

Have fun with the shorts, I-Man's out.

Dick Morris insists that the R's will pick up at least 60 seats in the House, and the requisite 10 seats in the Senate.

(http://www.dickmorris.com/blog/)

Morris can be a dick at times....

Yeah, didn't Morris get canned (by Clinton) for discussing political strategies with hookers?

tradefast

my last day off work was the last time the dow was below 10,000- i am taking off monday (dow above 11K) & i will take a day off every 1k pts

Perhaps he visited the Emperor's Club at the Mayflower Hotel. LB passed by there last night, of course I thought of Eliot and his socks.

Peter Schiff:

http://www.businessinsider.com/the-fed-is-about-to-throw-its-hail-mary-pass-2010-10

Can't touch this.... (market)

Not sure whether the Fed is going to throw the Hail Mary, but the markets have already run the route and are waiting in the End Zone, Karen!

(not that LB follows that Grid Iron Pigskin stuff...)

twitter is a tweet with what Cramer just said:

http://market-ticker.org/post=168616

Isn't "a tweet" supposed to be just one word?

short and sweet bond futures commentary:

http://www.aweber.com/archive/decarleybond/1ttot/h/Short_and_sweet_bond_futures.htm

Traders may get longer Ts in the last hour, 3-day weekend ahead, safety trade. Our short position is green at this point. Normally we would expect selling into the auctions next week, but in this market, who knows?

atweet as in aflutter, then.. better?

My heart is aflutter when you post near me, Karen.

Arent all markets open on Monday?

outrageous.. 10 min candles of $bkx and $spx the same.. tho diverged. $bkx went lower on the day.. have i mentioned that $bkx is read today?

no markets on Monday, I.. and be happy about it!

Yes markets.

How about:

My heart is aflutter when you post another.

U.S. stock exchanges are open for trading Columbus Day, October 11.

Wait...

NYSE is open, CME is open...

No rest for the weary...

Bond markets are closed, so bond traders will be cautious here.

I am an idiot.. sorry: It's the FED RES BANK that will be closed on Monday.. that could be a good thing! LOL

Additionally, Bond markets will be closed on Monday, October 11, 2010 in observance of Columbus Day. Stock markets will be open for trading on Monday, October 11, 2010 and full payment for securities transactions in cash accounts must be received within 5 business days of the trade date. However, Monday, October 11, 2010 will not be a settlement date.

Markets closed on Monday? Why?

So we can honor the guy who is fraudulently credited for discovering the Americas?

Sounds pretty typical, given the situation at hand...

I'll drink to that!

Oh even better...

The BANKING SYSTEM is shut down because of the guy that is fraudulently credited with discovering the Americas...

But you all can go ahead and trade your worthless stocks...

ROR

MOnday might be a bit thin. You know what that means..

Of course bond people think they're special...

surely we can tap 1170 by the close..

I have to pat myself on the back for that one...

CV framed that one nicely...

safe to go long here.. no way 1166.00 holds as hod.

all you need to know: Oct. 8 (Bloomberg) -- Crude oil climbed above $83 a barrel amid speculation the Federal Reserve will buy more debt to stimulate the economy after a government report showed the U.S. lost more jobs than forecast in September.

Oil rose as much as 1.8 percent as the dollar pared gains following the Labor Department report. The Fed may purchase bonds in a strategy known as quantitative easing, weakening the U.S. currency and boosting dollar-denominated commodities.

http://noir.bloomberg.com/apps/news?pid=newsarchive&sid=aVT61CN1SviI

and it was so easy, just ask Tepper!

monetizing all the debt, all the time

http://www.minyanville.com/businessmarkets/articles/national-debt-national-interest-rate-samuel/10/8/2010/id/30473

The high of the FLASH CRASH candle was

1167.58

It'll be interesting to see how that number is treated...

1165.87 was the close on May 5th... (day before flash crash)...

1167.58? stick a fork in it, then : )

the 3:09 and 12:44 1 minute candles are a sight to see...

both of them were the HERCULES move to print OVER the 1165.87

surely the Fed would like to see us above the Flash Crash... perhaps that and 11K plus have been the goal..

1173.73 was the next week's post flash crash high..

i wish someone could explain the last ten min candle to me.. the one that went from sub 1064 to 1166.40.

Daneric was kind of predicting at least one daily CLOSE "over" that day...

That's basically what happened to 1220...

Which was attempting to recapture the "Lehman Day" candle...

http://www.zerohedge.com/article/there-goes-wells-fargo-california-ag-calls-banks-halt-all-foreclosures-california

Tyler Durden has a way of putting things...

lol

"To see the prevailing schizophrenia gripping the two different sets of mindsets in the market right now, look no further than than the surging divergence between equity vol and implied correlation (VIX, JCJ) and credit vol (via swaptions: USSV011). The chart below shows that even as equity traders are going full retard into QE2, and expecting the Fed's Brian Sack to expense their purchases of such staples as hookers, booze and heroin next, rate guys are running for cove (guess what, the fact that going forward Americans will not pay mortgages again, likely for many months if not years, is not good news)."

"Of course bond people think they're special..."

We're just a little bit LARGER than the little yappy markets....

Hello!! is everyone shocked into a stupor that the foreclosure process is being halted across the USA???

What's "foreclosure"?

@karen (3:25)

I am... I seriously am ABSOLUTELY SHOCKED...

This, IMO, is going to end very badly, and ACCELERATE the downturn...

People are going to start defaulting willy nilly on everything...

Expect this to go viral...

This market should be down 3% on this news.. That and the Janet Tavakoli interview, and the jobs report, and the realization that this country is completely effed.

olive oil bitchez...

"the realization that this country is completely effed."

---

CV realized this in 2008 when he saw the PEGGY JOSEPH video...

I tried to tell everyone softly (by making a joke out of it)...

Guess what people? CV WASN'T JOKING...

I-Man, you are a devil!!

I think people will wake up on monday and say what?!

Maybe the shock is too surreal to grasp.. maybe they are jumping in their cars and heading to the mall now that their homes are virtual ATM machines again..

apparently, it is just being reported on television:

iuubob

RT @CGasparino: Citi and Wells Fargo likely to be next to freeze foreclosures....breaking news. $$

half a minute ago via TweetDeck

Reply Retweet

iuubob

Gaspo reporting $C and $WFC to cease foreclosures as well

sentimentrader

Update from last week..."smart money" hedgers now short $6.2b of $ NDX futures, down a bit from last week but still near record high.$$

at least the $bkx is still red.. have I mentioned that?

http://www.businessinsider.com/microsoft-stops-covering-all-healthcare-costs-for-employees-2010-10

Post a Comment